We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

In recent years much of the narrative is that China is rising, the US and the West as a whole are declining, and that there is not a lot we can do to arrest that switch, even if it would be desirable to do so, blah-blah-blah. Liberal democracy is on the retreat, authortarianism is the new hotness, so get ready for Social Credit, compulsory school Mandarin lessons and the rest of it. Now it is true that we seem to be well capable of gutting defences of liberty on our own without Chinese influence anyway, but it does nevertheless matter, in my view, if China’s rise continues in the way it has. Well, it is possible that things aren’t going to be quite so straightforward:

Check out this article from US think tanker Thomas J. Duesterberg, in the Wall Street Journal. As it is paywalled, I am going to publish a few paragraphs:

In December real-estate developers China Evergrande and Kaisa joined several other overleveraged firms in bankruptcy, exposing hundreds of billions in yuan- and dollar-denominated debt to default. Real estate represents around 30% of the Chinese economy, nearly twice the levels that led to the financial crisis of 2008-09 in the U.S., Spain and England.

I have been covering the Evergrande saga in my day job. Let’s just say that anyone who remembers the Japanese real estate meltdown will recognise the danger signs.

The real-estate industry has been key to keeping annual growth above 6%. Yet a debt bubble has inflated by 20% annually between 2014 and 2018. Originally intended to accommodate rapid urbanization for the industrial economy, the urban property market is now overbuilt. Some 90% of urban households own their own properties and enough vacant units are available to accommodate 10 years of urban immigrants. Sales and prices have tumbled this year, and overleveraged builders and creditors are suffering the consequences.

It seems the Dr Evil bloke at the helm is not as smart as he’s made out.

Mr. Xi is privileging the less productive and less innovative components of the Chinese economy while enhancing control, limiting financing and punishing entrepreneurial leaders in many leading industries. This isn’t a recipe for maintaining strong economic growth. Despite the frequent assertions that China is catching up or moving ahead of the West in technology industries, it has a long way to go to achieve the self-sufficiency and global leadership it seeks. U.S. sanctions on advanced semiconductors, for instance, have gutted Huawei’s ability to make its own 5G phones. China’s semiconductor industry is 10 years behind world leaders, according to a recent German study.

In short, it is difficult to escape the conclusion that China’s economy is systematically weakening and that Mr. Xi’s new priorities offer little hope for a quick turnaround. The U.S. and its allies could further compound Mr. Xi’s challenges by vigorous enforcement of trade laws, limiting Chinese access to technology and financing from the West, and imposing sanctions against China’s brutal human-rights abuses in Xinjiang and in countries in the developing world that it is trying to exploit through its Belt and Road Initiative. A good example of such exploitation is the atrocious mining conditions for key battery components cobalt and lithium in Africa and South America.

A major slowdown or acute financial crisis in China would certainly have a negative impact on the global economy. But U.S. and allied policy makers do have tools that could both influence the direction of the Chinese economy and help repair some of the accumulated damage to their economies from Chinese mercantilism. A first step is to undermine the narrative of a relentless, unstoppable economic advance under Mr. Xi’s leadership.

That of course would mean efforts to counter China’s thefts of Western IP, and for Western governments to limit Chinese access to Western finance and tech. That isn’t easy. Of course, a big slowdown/recession in China will hit the West, given the web of capital and trade relations. And for what it is worth, I still think the world is far better off with a prosperous China than the horrors of Mao in the 50s and 60s. But it is plain that China’s current behaviour (Hong Kong, South China Sea incursions, treatment of various groups, IP thefts, clashes with India, etc) mean that the regime in Beijing needs a very big kick. Maybe we will see this happen in the next year or so.

When President Joe Biden said, in one of his many foolish sayings, that “Milton Friedman isn’t running the show any more”, the hubris of that comment was truly on the Greek tragedy scale. Inflation is almost at 10 per cent on an annualised basis in producer price terms in the US. Consumer price inflation is also high. In the UK, inflation runs hot. Yes, disruptions and energy price spikes are big factors, but these are structural – and ultimately, what causes prices to rise overall is because money loses its purchasing power. (See this decade-old video featuring UK-based investment figure and author Detlev Schlichter.)

Across the developed world and beyond, that loss of purchasing power involves a huge shift in resources from savers to borrowers, with the latter being governments in many cases. Finance ministers won’t admit it, but they want inflation to resolve their fiscal incontinence without having to cut spending or raise taxes.

The late Prof. Friedman pointed this sort of process out many times. Yes, I get that not all aspects of the Quantity Theory of Money hold up, and the “Chicago” school has its disagreements with others, such as the “Vienna” one over money, banking, etc. But the broad point seems to hold that if you print government fiat currencies on a massive scale, eventually inflation will bite. President Biden is unfit for the office he holds for a variety of reasons, and his jeering at one of the great minds of the 20th Century is one of them.

Update: Bank of England slightly raised interest rates today.

Incoming from Dominic Frisby:

The YouTube premiere of our feature documentary Adam Smith: Father of the Fringe will take place this Sunday evening at 7pm and you are invited to join. I hope you can make it. If you can’t fear not, the film will remain on YouTube thereafter, so you’ll still be able to watch. We’ll leave it on there until some broadcaster with deep pockets wants to broadcast it.

See also my previous post about this.

On Monday night I attended a screening of Dominic Frisby’s film Adam Smith: Father of the Fringe at the IEA.

It is a documentary about how the government-subsidised Edinburgh Festival was usurped by amateurs who just turned up, organised their own venues and ticketing, and put on their own shows. The fringe festival was, and remains, a triumph of the free market. This is in spite of many of the performers being somewhat left-leaning. In the film, one comedian being interviewed points out that doing comedy for a living is very entrepreneurial, and that during the 80s most comedians were mocking Thatcher whilst doing exactly what she wanted.

It is a funny, entertaining and informative film. Dominic Frisby tells a good story. During the Q and A afterwards, one young questioner said that he was worried about his generation because they all seemed to think socialism was the right way. He thought that films like this might go some way to convincing them otherwise. There proceeded some discussion about how a good story is often more persuasive than facts and logic. Dominic pointed out that most people saw themselves as wanting to be nice, and the prevailing view was that anyone not on the left was unkind and uncaring. Clearly some better marketing is needed.

The counterpoint, demonstrated here, is that the state subsidised organisations are slow, curmudgeonly and favour the distinguished and established elites. The free market is for amateurs and small groups who experiment, fail, and provide much desired diversity of choice, interesting niche products and discovery of exciting new innovations. The film gives examples of all this happening at the fringe. During the Q and A, comparisons were made to YouTubers, who similarly provide diverse opinions and information on niche topics, as compared to the mainstream media who offer a narrow selection of often poorly researched information. It seems to me that the distinction between big and small organisations in general is relevant. Big companies who hold apparently unassailable apparent monopolies in some sector are regularly usurped by nimble startups despite the former’s capture of state favour.

After the event I chatted with the director of the film, Alex Webster. He had pointed out that cheap equipment was one of the things helping those YouTubers. It turned out we both own the same camera: the Blackmagic Design Pocket Cinema Camera 6K Pro. It is a relatively cheap device that can capture video with cinematic quality good enough for a Hollywood feature film. Blackmagic Design are making film-making cheap not just with cameras but with the editing, compositing and colour-grading software Davinci Resolve which anyone can download for free. This is one of the ways that young people with little money can develop their skills in film-making, and that small, independent, innovative, niche film-makers can afford to make their films.

Perhaps there is a chance that fringe-like dynamics might come to the aid of those who have the desire and ability to improve the marketing of the idea of freedom by telling some compelling stories about it.

As promised.

By the way, I found this rather good obituary of Brian by Sean Gabb at The Critic.

Update. The post was initially put up with the wrong link (hence Paul’s comment). It has now been corrected.

Brian and I recorded a couple of conversations which remained unpublished at the time of this death. This is the first.

Any comments – which would be gratefully received – are probably best left here on Samizdata.

Interesting and significant (probably) to see Brian’s influence all over the preceding post. My apologies to anyone reading this who didn’t know him and feels left out.

Our late colleague and friend Brian Micklethwait was very good at making people think. In particular he was very good at making me think, and even at times making me write. Often he would say something interesting that would make me write something as a response that I would never think to write for any other reason, and this blog, his own blog and its predecessors are full of articles and comments that were responses to things he started me thinking about. He had a tendency to repost my comments as articles when he found them particularly interesting, and many of our conversations took place in the articles and comment sections of various blogs. He loved posting photos of quirky things, fascinating objects, major pieces of architecture and engineering and interesting maps of places around the world that looked like they might be interesting.

Brian was not a great traveller. He was very pro-American, but he never visited the United States. He had done some travel earlier in life – including some behind the Iron Curtain before it fell, which I wish I had been able to do – but in the final two decades of his life when I knew him, he only ever really left London for regular summer trips to visit some friends in France. He clearly enjoyed this immensely, but travel was too much of a hassle for him unless there was warm hospitality as well as good company at the end of it.

He did, however, inspire me to travel. I saw photos of interesting things on his blog, and I researched them and wanted to go there, and I often did. He found this amusing, but he also liked to talk about what I had seen and photographed with me, so this continued the thoughts and conversations. (I still haven’t been on the Darjeeling Himalayan Railway, alas, although I have been on the similar but not quite as spectacular Matheran Hill Railway south of Mumbai).

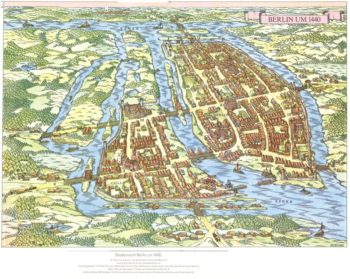

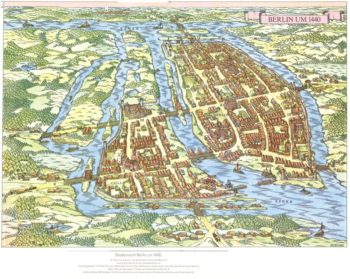

In any event, in March this year Brian posted a pictographic map of Berlin in 1440 that he knew nothing of the origins of Berlin, but that he found the map interesting, showing a town or small city on two islands in the river Spree with a third island on the left that was at not that point significantly populated. As it happened, I knew relatively little about the origins of Berlin either, but I was instantly curious. I have been to Berlin many times, but I couldn’t have told you where the original town was. (Actually Berlin was technically two towns at the time – Berlin on one island and Cölln on the other). So I researched it, and discovered that although Berlin had some medieval city walls, these had not protected the city well in the Thirty Years War. The relatively unfortified city had subsequently been fortified into a star fort between 1650 and 1683, at which time the two outer streams of the river surrounding the three islands had been turned into a moat and the inner banks replaced with high walls. These walls then subsided into the swamps on which Berlin was built and were torn down starting in 1734, after which the two outer streams of the river were filled in, leaving only one island. The route of the north-easterly wall/stream was eventually used as the route for the Stadtbahn – Berlin’s main east-west railway. The south-easterly route, well, it was filled in and replaced with a layout of streets. Where it was is not obvious on a map or in a photograph.

I also found some modern maps and photographs of Berlin, and sent them to Brian. The inner island, the Spreeinsel, is recognisably the same between the oldest map and the newest photo, and does still have some remnants of being the important centre, including Berlin’s protestant cathedral, but the northern half northern half of it became the site of Berlin’s greatest museums, many of which have been reconstructed in recent times and restored to something even beyond their pre-WWII glory. In the comments, further conversation ensued. More people got involved in the conversation.

Inevitably in all this, I booked a trip to Berlin to wander around and look at the city from this new (or old) perspective. This was originally booked for April 2021. This was optimistic on my part given the circumstances, but I have actually done a lot of optimistic booking of travel over the last 18 months, the vast bulk of which has subsequently been rebooked, postponed and/or cancelled. (Lots of things have been ludicrously cheap to book due to travel companies promising anything in return for being given even small amounts of money, and have then been deferred to the indefinite future. Hopefully these companies will not now go bankrupt when they are forced to catch up with their liabilities). In any event, this trip was postponed to this month.

And, well, on Friday October 15 I got on a plane having received the awful news earlier in the day that Brian had died that morning.

Trying to find old things in Berlin is a struggle. There was a fairly small town there in 1400, but since then it has been drained, expanded, made a provincial capital, rebuilt, fortified, invaded once or twice, expanded again, demolished, rebuilt again, expanded some more, fortified, rebuilt again and turned into an imperial capital, torn down, blown up, bombed to rubble, blown up some more, turned into a communist capital, demolished again, neglected, expanded some more and rebuilt again and made into a national capital, just giving he highlights. In most cities, the geographical and historical bones stick through. In Berlin, much less so. The watercourses to some extent, but that is all.

I attempted to look for remnants of the old city walls. In most cities it would be helpful to type “[City Name] wall remnants” into Google, but “Berlin Wall Remnants” gets something else. To make things even more complicated there was another wall, the Customs Wall, that was built around 1737 for tax collection purposes (boo). Most Berlin place names refereeing to gates (most notably the Brandenburg Gate) refer to this wall. So, I actually found myself looking at the original maps of Berlin in 1440 (and the later map of the star fortress in around 1683), looking carefully for the rights bends and branches and former branches of the river. I started well, finding a piece of (obviously restored) medieval city wall in Littenstrasse>. But that was it for finding further pieces of wall. I followed the approximate line of Littenstrasse through Alexanderplatz, just to the south of the Stadtbahn along the top of what had been Alt-Berlin.

The street plan had been changed by the centuries and the Prussians and the fascists and the communists, and I found nothing more medieval. I crossed the Spree at Bodestrasse, between the Neues Museum (now again containing the bust of Nefertiti, as it did before 1939) and the Berliner Dom, the now restored protestant cathedral that had still been in post-WWII ruins when I first visited Berlin in 1992. I then doubled back to the top of the island before walking past the Humboldt University of Berlin, through Bebelplatz (site of the Nazis infamous book burnings), past the Roman Catholic St. Hedwig’s Cathedral (at present closed for the East German post-war modernist restoration to be removed and replaced with something more tasteful and less full of asbestos) and Oberwallstrasse, Niederwallstrasse, and Wallstrasssse, the latter three streets following the route (with a little straightening) of the wall of the star fortress, at least some of the bends in the shape of that wall being apparent. And back where I started, but on the other side of the river, having circumnavigated the old cities of Berlin and Cölln.

But there was one more thing to see. When we were looking at old and new pictures of Berlin, Brian’s cousin (I think) David Micklethwait commented that the only building that could be seen in the first, last, and intermediate pictures of Berlin was the Berliner Schloss (Berlin Palace), originally the Churfurstl Schloss (Elector’s Palace), home of the heads of House of Hohenzollern during their long journey from Margraves of Brandenburg to being Emperors of Germany before Kaiser Wilhelm II was forced to abdicate in 1918.

Except, I did some further research and it is stranger than that. Rather than being the oldest building in the later photo of Berlin, the Berliner Schloss is actually one of the very youngest – the current building was completed in 2020. The original building was badly but not irreparably damaged in World War 2. The East Germans at times used it as a backdrop for a War movie (including firing live ammunition at it), partly repaired it and used it as office space, denounced it as a symbol of Prussian militarism, and finally demolished it in 1950, partly for ideological reasons but mainly because they were arseholes. The Palace of the Republic – the East German parliament – was then built on the site. After German reunification in 1990, the new German government demolished this building, partly for ideological reasons and partly because it was full of asbestos.

After much discussion, the Palace was rebuilt as the Humboldt Forum, a museum featuring a reconstruction of the Berliner Schloss on the exterior but with an entirely modern interior. (The result was then denounced by the New York Times as an attempt to hide the history of Prussian militarism). Brian found this amusing, as it fitted in with another of his ideas – the triumph of modernism on the insides of buildings but not so much on the outside. His recent thoughts on this subject came in the context of hospitals, alas.

So, I finished my walk around old Berlin with a visit to the Berliner Schloss / Humboldt Forum. And, well, it’s weirder than that.

If you are going to reconstruct old buildings after a war, there are a few things you can do. You can take what is left, and use modern techniques and designs to rebuilt the rest, leaving you with a building that is half and half new and old. (Lots of buildings in Britain and for that matter in West Germany that were quickly rebuilt after WWII are like this). You can reconstruct the new parts in hopefully a sympathetic and complementary style, but also in such a way that the new bits are obviously new rather than old. (Much of the recent restorations of central Gdansk are like this, and I like them a lot). You can attempt to restore the damaged part of the building to the same design as before. The aforementioned Berliner Dom is an example of this. Or you can demolish the ruins and start again, either in the same style or differently. Rebuilding exactly what was there before (as was done in the centre of Warsaw) perhaps works if you do it right away (as the Poles did) but the longer you leave it, the more the result looks like trite and artificial, at least at first. (For an example, look at the Dresden Frauenkirche. It’s a brand new Baroque building with no wear built to modern health and safety standards)

And well, the architects who rebuilt the Berliner Schloss decided to make the fact that it is a reconstruction obvious, by building the front wall (including the main entrance) and two side walls as perfect reconstructions of the original down to every detail, but the back wall in a rather severe modernist style. Similarly, the main courtyard has three interior walls in the Prussian Baroque style of the original building and one in modernist wall. If you look at the building from the front or the sides, it looks like an (admittedly brand new) Prussian Baroque palace. From the back, it looks like a modernist building. From other angles, it looks mostly like an old building, but not quite.

Does it work? I’m not sure. It would have no chance of working anywhere other than in the strange city of Berlin, which is a mix of old and new and original and reconstructed and broken and repaired and has been a showcase of every German regime for the last 500 years – for good or for bad.

A month ago, and a year ago, and ten years ago, and twenty years ago, I would have talked about all this with Brian when I got back. I might have e-mailed him photos when I was still there. There would have been more sharing of photos and conversing and commenting on blogs. He might well have called me an idiot if I said something I disagreed with. I have no idea whether he would have liked or disliked the rebuilt Schloss Berlin, but he would have had something interesting to say about it. He loved talking about what buildings looked like in the context of the surrounds of the cities they were in, and found that too much architectural commentary didn’t focus on this and instead talked about buildings in isolation. I agreed with him on this point, which is one reason why I go places to see stuff.

Anyway, the point is that I miss Brian. Fuck cancer.

The Prime Minister’s rhetoric was bombastic but vacuous and economically illiterate. This was an agenda for levelling down to a centrally-planned, high-tax, low-productivity economy.

– Adam Smith Institute review of the Prime Minister’s speech at the Tory conference.

“Berlin’s vote to take properties from big landlords could be a watershed moment”, writes Alexander Vasudevan in the Guardian.

Judging by the history of such schemes it could be. But not in the way he thinks.

The vote in Berlin is not legally binding, but it does show the popularity of such a measure (the popular appeal of taking their stuff and giving it to us is eternal), and as the Guardian says it will “serve as a template and inspiration for activists in Europe and elsewhere”.

Professor Vasudevan (he is an associate professor in human geography at Oxford) continues,

Smaller landlords and state-owned social housing have been aggressively targeted by large institutional players for whom housing has become a vehicle for the management of global capital funds.

I have little doubt that the large scale institutional landlords such as the property company Deutsche Wohnen that the initiative targets have transformed the Berlin housing market, and not for the better. But it is worth asking why it paid them to to go on a speculative property buying spree in the last few years when it did not pay them to do this earlier? I would guess it is because they have taken advantage of artificially low interest rates created by government.

What about compensation? For obvious historical reasons, German law frowns on confiscation without compensation. The article says,

Efforts to enact the socialisation process will undoubtedly face legal challenges, not to mention the problem of compensation of the property corporations. Campaigners are adamant that their model would balance a commitment to fair compensation with “budget-neutral” socialisation.

When fair compensation is “balanced” with something else, it means unfair compensation.

When the normal operation of law is suspended we are always told that it will apply only to people or groups that few would leap to defend. It never stops there.

Britain’s electricity supply is in peril. On Monday (20 Sep) the Financial Times reported,

Peter McGirr wanted to modernise the British consumer energy market when he founded Green three years ago, building a customer base of more than 250,000 households. Now, with the sector in meltdown, he says it is “incredibly unlikely” the Newcastle-based supplier will survive until Christmas without government intervention.

Five smaller suppliers have collapsed in the past six weeks, with four or five more expected to join them in the next 10 days as the industry is battered by unprecedented surges in wholesale electricity and gas prices.

Observers are predicting as few as 10 suppliers will make it through the winter, implying 40 could go bust. Some executives have privately suggested the sector could go back to a big four, five or six companies.

How did this happen to us? I know who to blame for setting the UK on this disastrous course. On Tuesday 24 September 2013, eight years ago tomorrow, the then Leader of the Labour party, Ed Miliband, gave his big speech to the Labour party conference in Brighton. One item was particularly popular:

“If we win the election 2015 the next Labour government will freeze gas and electricity prices until the start of 2017. Your bills will not rise. It will benefit millions of families and millions of businesses. That’s what I mean by a government that fights for you. That’s what I mean when I say Britain can do better than this.”

The response from the Tories was immediate and scathing:

As the Guardian reported,

Energy minister Greg Barker attacks Labour’s plan to cap energy prices

In response to Ed Miliband’s announcement, the energy minister says capping energy prices would have catastrophic consequences for investment in the UK

Figures from the gas industry chipped in:

The lights could go out if Labour introduces its 20-month freeze on energy prices, Ian Peters of British Gas said. “If we have no ability to control what we do in the retail prices” and wholesale prices suddenly go up within a single year “that will threaten energy security,” he said. Asked if that meant the lights would go out, he replied: “I think that is a risk.”

But Mr Miliband’s policy had equally vigorous defenders. On 25 September 2013, the day after Mr Miliband’s speech, Alex Andreou of the New Statesman thundered:

Ed Miliband’s critics think his energy pledge will make the lights go out. They are wrong

The critics were wrong. Ed Miliband is innocent OK! It was not his pledge that a Labour government would limit energy prices that has brought us so near to having the lights go out.

The Conservative manifesto of 2017 included energy price controls, duly introduced by Prime Minister Theresa May on 1st January 2019.

And here we are.

The government has published this UK gas supply explainer.

There has recently been widespread media coverage of wholesale gas prices, and the effect this could have on household energy bills. The impact on certain areas of industry, and its ability to continue production, has also attracted attention.

This explainer sets out the background to the issue and the action the government is taking to protect the UK’s energy supply, industry, and consumers.

Natural gas prices have been steadily rising across the globe this year for a number of reasons. This has affected Europe, including the UK, as well as other countries around the world.

Later, the author of the “explainer” reassures us consumers that energy prices may not go up as much as one might expect:

The high wholesale gas prices that are currently visible may not be the actual prices being paid by all consumers.

This is because major energy suppliers purchase much of their wholesale supplies many months in advance, giving protection to them and their customers from short-term price spikes.

The Energy Price Cap is also in place to protect millions of customers from the sudden increases in global gas prices this winter. Despite the rising costs of wholesale energy, the cap still saves 15 million households up to £100 a year.

Isn’t it nice that the government protects consumers by stopping energy firms passing on price rises?

Completely unrelated: Four more small energy firms could go bust next week, the BBC reports.

Some of you may remember that the Bishop Hill blog used to cover climate and energy issues in a moderate and well-informed way. Unless I missed the announcement of a move, that blog does not seem to have been active since 2019. However I recently found that the Bishop is on Twitter, one of the few reasons left to visit that horrible place.

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|