Yesterday afternoon I was out and about walking in London, and just before I got to Parliament Square I encountered a demo. It was not raucous or unpleasant. It was nice. It was old people complaining about their council taxes, which obviously I am all in favour of.

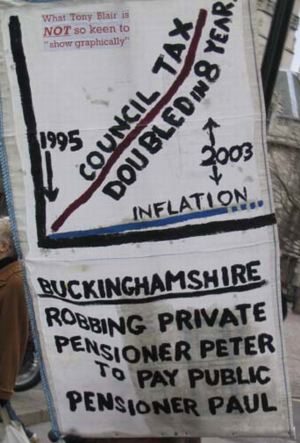

Following the example of supreme Samizdatista Perry de Havilland, I now take my DigiCam with me whenever I go a-wandering, so I was able to start snapping. At first it was just nice old people accompanied by nice policemen, with nice buildings in the background, but only very crude signs to say what it was all about. However patience was rewarded, and some of the signs were highly informative.

27.2%. Ouch! Whatever happened to stealth taxes? (Hey hey LBJ, you killed 27.2% more kids today than yesterday, you bad bad person. Not the same ring to it, somehow.)

And this one takes onlookers into the university lecture theatre.

Okay, okay, I’m excited, and I want to know more. How can I follow it up?

Wow, a website. They say, in fact Perry just said it to me in connection with this post, that a picture is worth a thousand words, but I reckon best of all is pictures with words embedded in the pictures, explaining everything. Preferably with an internet link.

Yes, my landlord (in Croydon) very apologetically asked me if I minded if he increased my rent a few weeks back. This tax increase was why. I can’t say I blame him. .

All very good, but I’m not that comfortable with the British Legion’s involvement.

Well done, thou good and faithful servant !! You have done precisely what blogs are for!!

What they want, is replacement of council tax with “a system reflecting the ability to pay” ie: local income tax or means tested council tax. They’re socialists, basically. That’s where the “is it fair?” question comes from.

The concept of “scrap the local council spending” doesn’t seem to occur to them.

I expect the government to “cave in” after a pretence of resistance. “Please don’t throw me into that briar patch, Brer Fox!”

Julian is right.

These people have no interest in limiting what the state does or spends. They just want somebody else to pay for it, not them.

They don’t deserve our support.

Hmm, I wonder how the strategic situation would change, if this lot get what they’re asking for? Local councils are small enough that libertarian “independents” could win their elections. A local income tax would take the pressure off pensioners – but pile it onto the working middle class. Running on a tax-cutting manifesto might suddenly become saleable.

Yes, as much as I’d like to support this, it’s a nimby movement really. They want people like me (dual-income, no dependents, etc…) to pay their tax for them. No thanks. I’d rather just pay for a private fire service, bin-collection, police force, etc… myself.

Regards

It was old people complaining about their council taxes, which obviously I am all in favour of.

The taxes, the old people, or the complaining?

Last time I checked, there were no pensioner marches against excessive food prices, rents, or heating bills. It is the compulsory nature of tax they are principally objecting to. That’s a perfectly respectable position.

Where is the evidence for nimbyism or a love of high council spending?

The evidence is the widespread use of “it’s not fair”, meaning “someone else should pay more, and we less” rather than that the procedures of collection are unjust.

If they get their wish for a local income tax, then they’ll find out about procedural unfairness, and the difference between tax rate and tax burden.

The irony is that they’re quite right, it is unfair. It’s unfair for anyone to have to pay any tax – and more-or-less poll taxes such as council tax do have a disproportionately harsh impact on the poor. I should know, I’m none too rich myself.

Actually, it’s “more fair” to be forced to pay a tax for a benefit you receive — everybody knows TANSTAAFL, although everybody is happy to be treated to a free lunch if they CAN get somebody else to pay.

Better lib action: signs that clearly state “Getting less in benefits than we paid in taxes – UNFAIR!”

Why? Because if folk got all their own taxes back in benefits, it would clearly be more fair. But the desire for more benefits that somebody else pays for would run smack up against fairness.

Corruption — using gov’t force to benefit from Other People’s Money.

Libertarians need to be very strongly against corruption, especially populist, democratic corruption.

I would take issue with Julian’s statement that poll taxes are unfair because they impact disproportionately on the poor.

Why isn’t it unfair to charge some people more than others for exactly the same bundle of goods and services? For that matter, since “the rich” can’t access many of the (welfare) goods and services that their taxes are spent on, why isn’t it grossly unfair to charge some people more when they will receive in return less.

I have always found the notion that “progressive” taxation is more fair to be suspect. It all comes down to you definition of “fair,” of course, but it is by no means a given that charging some people more for less is the fair thing to do.

To my mind, the most obviously fair thing to do is to charge everyone the same. Equal treatment ofr all, and all that. If this leads to a harsh impact on the poor, well, maybe thats a sign that your damn taxes are too high.

As DeTocqueville once said, “The American Democratic experiment will succeed until the people realize they can vote themselves money from the public treasury… then it will collapse.” This is the case with any democracy, unless they have a constitution strong enough to prevent it. In the States, unfortunately, we have managed to corrupt and ignore our constitution. Sometimes I wonder if we need to reboot the system. We certainly need to get rid of some errors and virusses.

Suggesting one should get as much in services as one pays in taxes, or even that all taxpayers collectively should, is like demanding a perpetual motion machine.

If I agree that there are some things that are necessary to support out of taxation, this need not be for my direct benefit, and the issue of fairness of taxes need not be related in any way to the distribution of tax spending.

However that’s not the way government is sold to voters in most modern democracies. It has become a form of auction in which parties don’t try to persuade that their programmes are good in themselves, but to convince the maximum number of voters that someone else is paying for this round–in the name of “fairness”. The better that expectation is established, the more must be taken from everyone to redistribute, and the harder the trick is to pull off.

BTW – I believe Aristotle spotted that flaw in democracy a bit before De Tocqueville…

R. C. Dean asks “Why isn’t it unfair to charge some people more than others for exactly the same bundle of goods and services?”

I didn’t say it was any more unfair than other taxes, I said it’s disproportionate. The “exactly the same” bit is the problem. Free market solutions present a range of options, at a range of prices. Poll taxes can’t be “economized”, and that hurts the poor.

Example: as a portion of council tax, everyone pays to have their runbbish collected by dustmen and a truck. Some poor people would probably prefer the option of “lug it down to the dump yourself”, but that’s not offered.

It’s almost like we need some sort of local tax, or charge really, that is based on the amount people can pay and the services that they receive. Something to refelect their cost in the community and make the councils more accountable. It could be called the Council Charge or something like that 😉