…here’s a theory:

For months now, people have asked me, why did China's stock market suddenly take off last year? I just realized: crackdown on granny dancing

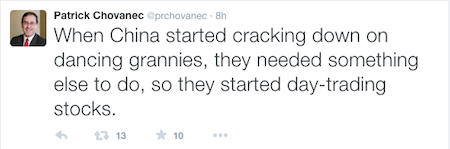

— Patrick Chovanec (@prchovanec) June 29, 2015

"From today, public dances will no longer vary by neighborhood, but will become nationally unified" http://t.co/Cpn2ODDneI

— Patrick Chovanec (@prchovanec) June 29, 2015

From this … to this … pic.twitter.com/Js95UsMZMk

— Patrick Chovanec (@prchovanec) June 29, 2015

That's my theory, anyway, and I'm sticking with it.

— Patrick Chovanec (@prchovanec) June 29, 2015

I apologise for the non-Twitterish look of this but it seems Samizdata’s all-knowing editing software doesn’t like scripts and I don’t have the patience to select, save and edit each tweet individually.

Update

It occurs to me there’s a bit missing from the tale. And just to prove that this really was on Twitter:

I cannot tell who is taking the piss out of what here.

Wow. Just wow.

I for one don’t like the Twitter embed script. For a site predicated on sending messages of 140 characters or fewer, the script is a bad memory hog. Plus, it takes longer to load than the rest of the page, so when you try to read a page with a bunch of said scripts, the page keeps jumping around.

Monetary policy (as far as can be worked out – given the unreliability of figures from the People’s Republic of China) is loose in China.

As for the “crackdown on granny dancing”.

The head of the Communist Party (i.e. the main figure in the PRC regime) has, for the last couple of years now, been a “crackdown” type (on all sorts of things).

Just in case anyone does not know – if a stock market goes up dramatically over time for no obvious reason, monetary expansion is the cause.

The new credit-money has to go somewhere – and the stock market or the real estate market (or sometimes both) are the normal places for the new credit-money to go.

In 1989 in June I went to see executives of Nomura Securities and Daiwa Securities on Wall Street. My thesis was as a hedge fund director that the Japanese stock market at 35,000 on the Nikkei was insane. The Japanese Stock Exchange was at levels that made no sense and it was bound to decline. Japan’s property market was worse, with the 160 acre Imperial Palace in Kyoto having a value greater than all the real estate in California.

Both representatives of the largest two Japanese brokerage houses said, “Japanese stocks never go down. Japanese real estate only appreciates”.

Then this happened:

http://www.thedigeratilife.com/images/japanchart.png

Property prices crashed and never recovered to this day, 26 years later.

There is something in the water in East Asia that is different perhaps.

Ya think Mao had a problem with dancing women?

Thus the issue of older women dancing in public?

Lots of Stock markets are going crazy, and not just because of China. I didn’t think a socialist party would ever want to break up a political union (they tend to disapprove of political divorces). But that’s what we see in Greece.

So here’s the first Greek joke on the subject!

Q. How many Greeks would it take to change a light bulb?

A. At least 2 million. The first million could pool their money to buy a light-bulb, and the second million to hire an electrician to do the job!

The Chinese financial system is totally politicized and corrupt, much like the Japanese system mentioned above, and the housing finance system that collapsed in 2008.

The numbers are unreliable, the motivations are completely non-economic, and the level of theft and fraud is incalculable.

The problems in the financial sectors of the EU are well known, and the endless magical thinking of the ruling masters shows no sign of being replaced by anything realistic.

Some very ugly chickens are circling, and getting ready to come home to roost.

Veryretired, I think I saw your chicken!

Laird, I remember seeing that movie when I was a kid. It’s right up there, or down there, with “Plan 9 From Outer Space” and a few other memorable sci-fi turkeys. What a hoot!

Laird, for goodness sake! That movie is a turkey!

Very, I just saw your comment — you got there first! Great Minds, I guess. :>)!

I reckon what happened in China was that some party bigwig read some bit of nonsense in China Daily about how dancing grannys were clogging up the squares in Beijing and decided on a crackdown.

I mean, what a way to run a country!

It would be like Theresa May reading some “10 ways porn harms kids” click bait in the Daily Mail and immediately passing a law against it.

Or Osborne reading a ‘Houseprice Shock’ headline and basing the financial policy of the country on it.

Never happen here.

Back in 2007 I knew the real estate market was about to implode when a guy who was selling weed quit to start flipping houses. A market is always near a top when the dumb money starts pouring in. So, on to China. Money quote: “Some 67.6% of households that opened new accounts in the past quarter haven’t graduated from high school..[snip].. Only 12% have a college education. Among existing investors surveyed, only 25.5% lack a high school diploma; 40.3% have finished college.” Many of these people have never traded, and cannot tell preferred stock from livestock. When the margin calls come in, they will stampede out, tanking the market and triggering more margin calls. The decline will be glorious.

If you do not buy the behavioral take, look at some fundamentals. It’s hard to excerpt this one, but for a taste, try this: “In Hong Kong, Jicheng Umbrella Holdings (which makes, yes, umbrellas) went public in February: its shares are up almost seventeen hundred per cent.”