We are developing the social individualist meta-context for the future. From the very serious to the extremely frivolous... lets see what is on the mind of the Samizdata people.

Samizdata, derived from Samizdat /n. - a system of clandestine publication of banned literature in the USSR [Russ.,= self-publishing house]

|

Economic progress tends to increase insofar as the savings result in a larger supply of capital goods, which serves to increase production, including the further production of capital goods. The rate of return on capital tends to fall because the larger expenditure for capital goods (and labor) shows up both as larger accumulations of capital and as an increase in the aggregate amount of costs of production in the economic system, which serves to reduce the aggregate amount of profit. Our problems today result largely from government policies that serve to hold down saving and the demand for capital goods. Among these policies are the corporate and progressive personal income taxes, the estate tax, chronic budget deficits, the social security system, and inflation of the money supply. To the extent that these policies can be reduced, the demand for and production and supply of capital goods will increase, thereby restoring economic progress, and the aggregate amount and average rate of profit will fall.

– Reisman is dealing with Piketty and his assertion that because returns on capital can outpace economic growth in general, that this is some sort of bad thing, to be stopped, banned and generally supressed. Perry Metzger of this blog has already done a lot to demonstrate the economically insane nature of Piketty’s analysis.

In summation, if you want to increase incomes, then an essential step is to stop attacking capitalists (not to be confused with crony capitalists tapping the public sector for privileges, etc).

Reisman has another devastating take-down on Piketty and his ideas on capital, at the Ludwig Von Mises blog. (Thanks to Paul Marks, frequent Samizdata commenter, for the pointer.)

Let me get this straight. The World Cup is being held in Brazil. Prior to this tournament there was a ban on consumption of alcohol inside stadia in Brazil, but FIFA insisted that the ban be overturned because one of their sponsors is a brand of beer and their contractual relationship with the brewer of this beer required that it be on sale inside the stadia during the World Cup. Fans at these matches have apparently been buying this beer and getting unbelievably drunk. The impressive cogitative processes operating in the brains of senior FIFA officials are now just starting to deduce that there might have been a reason for this ban in the first place.

Soon, Russia is authoritarian and corrupt. Also, it is hot in Qatar in summer.

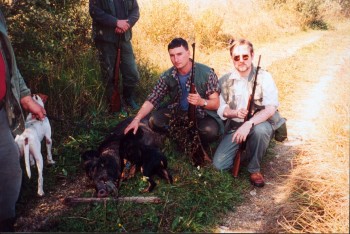

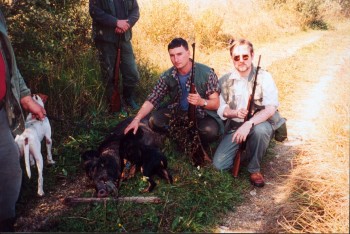

I have been watching with mild interest as a furore brews over a very pleasant looking US huntress called Kendall Jones, posing with a variety of African animals who have snuffed it. And so in this intolerant age in which we live, there are howls of outrage that she dares post pictures of her prey, with demands that facebook ban her.

One might be moved to speculate how many of the people complaining will then go a stuff their faces with factory farmed meat products produced in what are effectively concentration camps for animals, and yet see no irony in their indignant outrage.

No prizes for guessing where my sympathies lie…

I, and I am sure many other readers of and writers of Samizdata, have been following the career of Steve Baker MP, ever since he was elected MP for Wycombe in 2010. However, the last posting I did here about Baker elicited understandable scepticism from commenters about whether Baker would stick to his free market principles long enough to make any difference. Yeah, sure, he is now on the Treasury Select Committee. Big deal. Baker, like all the others, said doubters, would soon go native.

Well maybe he will, but he hasn’t yet. Not if this City A.M. report by Peter Spence about Baker’s latest sayings and doings is anything to go by:

In almost every area of economics we’ve accepted that markets do it best, he says. Few could imagine a committee of nine wise men deciding how we produce food, clothes, cars, or mobile phones.

But when it comes to producing money, we’ve accepted just such an arrangement. And for Baker it’s crazy that this has led to an obsession with what men like Carney have to say. That we’re trying to decipher from after dinner comments the trajectory of monetary policy is illustrative of the mess we’re in. “The truth is this is like kremlinology, have we worked out what the politburo thinks? It’s mad.”

We see the same thing across the Atlantic, where former Federal Reserve chairmen Alan Greenspan and Ben Bernanke have both given speeches to investors shortly after leaving the office. What investors think about US monetary policy has knock-on effects around the world, evident after last summer’s “taper tantrum”, as the Fed stumbled towards scaling back QE.

“It’s amazing we tolerate this,” says Baker, as words from both men have had the power to move markets, such is the extent of the “kremlinology” investors are hooked on. “I want the people doing this kreminology, making their living doing it, to question whether this is actually a free market,” he says.

“I think we operate a kind of monetary socialism, and it’s the single biggest institutional problem with our economic system.”

That bit about wanting people to “question whether this is actually a free market” is the bit that really matters here, I think. Clearly, Baker wants all such questioners to realise that the answer is: “No”.

Much of the problem with the world’s financial system these days is the most observers of it don’t even seem to think of it as a nationalised, government dominated system in the same way that tractor production was a nationalised, government dominated system in the old USSR. It is simply inconceivable to them that “money” could, by its very nature, be anything but a nationalised industry, so much so that to think of it as a “nationalised industry” is beyond them, because even to use such a phrase is to allude at least to the possibility – the thinkability – of a non-nationalised, free market version of the same industry. This is not a debate about how the nationalised industry of money should be managed, so much as a debate about the fact that it is a nationalised industry. Or, it would be such a debate, if only people like Steve Baker MP can manage to get such a debate started.

No doubt many Soviet tractor-makers felt similarly about what they did. That too, they were sure, just had to be run by the government, or else tractor making would descend into a black hole of chaos and impossibility and absurdity. The idea of a “free market in tractors” was, for such people, literally unthinkable. And millions in the West mocked all this nonsense. So, why do the descendants of such mockers – literal and intellectual – not mock their own Central Bankers now, just as Central Tractorers were mocked back then?

People may respond to Baker’s challenge by saying: “Yes, it is a nationalised industry, and a good thing too.” But for people even to talk like that would be a huge shift in thinking, because the fact of monetary nationalisation would have been accepted, even as it is being defending.

Until the metacontext (to use a favourite word here) of this debate is changed, free market capitalism will go on getting the blame for all that is wrong about the world’s financial system. And the “solution” will continue to be to restrict free markets in financial matters ever more ferociously.

Keep it up Mr Baker. You have not gone native yet. And you have an admiring fan club out here that continues to notice and continues to applaud.

In a comment on my previous post, Mastiff wrote, “It is easier for me to buy stock in Microsoft than it is for me to buy equity in my friend’s clothing design business down the street, thanks to the state of securities law. So which will I tend to do?”

Which is a very good point indeed, and something I had not really considered that now seems obvious. It is just another way that large incumbents can use the state to stifle competition.

However, I have not read the Financial Conduct Authority’s policy statement on crowd funding, but there do seem to be some interesting ways of investing in small companies. Have a look at Abundance Generation, Seedrs, Bank To The Future and Crowdcube.

In the USA, there was the Jumpstart Our Business Startups Act, and Rock The Post offer startup investing.

Is this the start of something world-changing, or is it set to be stifled by too much regulation?

Why then are tens of thousands of Latin Americans willingly flooding into a supposedly racist country where cutthroat capitalism ignores the poor and the oppressed such as themselves? In most past polls of Mexican citizens, two general themes often show up: the majority of Mexican nationals believe that the American Southwest still should belong to Mexico, and a sizable minority would like to leave Mexico for the U.S. You figure out the mentality.

– Victor Davis Hanson (H/T, Instapundit.)

Travelling to a country, then despising it, does not strike me as a way to win friends and influence people. I don’t know how widespread this issue is in the US – I’d be interested in comments from US-based readers about the situation on the southern border of the US.

Positive Money want to end fractional reserve banking and have the state create money directly. According to them, when quantitative easing created £375 billion, only £30 billion was made available for the government to spend, at a time when construction workers were being laid off and school building plans to fix leaky buildings were cancelled (which juxtaposition made for a nice Facebook meme). The quantitative easing also caused a stock market bubble and made some rich people even richer.

Instead, the government could have simply invented some sovereign money, debt free with no bookkeeping, and paid the builders to fix the schools. No unemployment and happy children.

Detlev Schlichter points out that it is the government who encourage fractional reserve banking, and all that really needs to happen is for them to stop doing this and banks will create some money but not nearly as much. Also, having the state create money is no less a recipe for disaster than having the banks do it, and maybe more of a disaster. The same economic distortions will apply.

If I attempt to apply Detlev’s thinking, I imagine that perhaps the state invents lots of money and gives it to schools to spend on building repairs. Suddenly the demand for construction is skyrocketing. Prices go through the roof. This stimulates supply. Software developers and professional bloggers quit their jobs for better paid jobs in the construction industry. Whole new construction businesses are started. Pensioners put all their savings into construction industry shares. And then all the school buildings get repaired, and the government moves on to curing some other perceived shortage, and the construction bubble bursts and you are back to having unemployed construction workers and starving pensioners.

Now, Positive Money responded to Detlev Schlichter. It turns out they more or less agree with him — apart from the bit about how we do not need anyone at all to create money, which they never got around to addressing directly but I gather from their criticism of Bitcoin is because they think without inflation people will speculate and not spend. But, importantly, they do not trust politicians to control the money supply either. It turns out they think some sort of “public and transparent body” can do it.

The whole thing strikes me as wishful thinking. It sounds so good it might even get somewhere. You get to bash bankers and have free money and keep politics out of it. All you need is for the public and transparent body to stay truly transparent and public and be able to manipulate the economy with precision from a central point of control. What could possibly go wrong?

|

Who Are We? The Samizdata people are a bunch of sinister and heavily armed globalist illuminati who seek to infect the entire world with the values of personal liberty and several property. Amongst our many crimes is a sense of humour and the intermittent use of British spelling.

We are also a varied group made up of social individualists, classical liberals, whigs, libertarians, extropians, futurists, ‘Porcupines’, Karl Popper fetishists, recovering neo-conservatives, crazed Ayn Rand worshipers, over-caffeinated Virginia Postrel devotees, witty Frédéric Bastiat wannabes, cypherpunks, minarchists, kritarchists and wild-eyed anarcho-capitalists from Britain, North America, Australia and Europe.

|